11-August-2025

- Scrap imports reach 4.6 mnt in Jan-Jun'25

- Domestic scrap consumption up 15% to 15.08 mnt

- Japan, Singapore witness sharp surge in shipments to India

Morning Brief: India's ferrous scrap imports rose by 18% y-o-y in January-June 2025 (H1CY'25) reaching 4.58 million tonnes (mnt) compared with 3.88 mnt in the same period of last year, as per BigMint data. Scrap imports edged up due to higher crude steel production, strong growth in scrap usage, and the arrival of shipments booked earlier.

Shifting market dynamics

However, market dynamics have recently shifted, with Indian steelmakers showing greater interest in imported hot briquetted iron (HBI), iron ore pellets from Oman, direct reduced iron (DRI), and domestic scrap, as global uncertainties and more competitive local pricing weigh on imported scrap demand.

Scrap buyers basically sourced previously booked cargoes, with fresh bookings not increasing commensurately.

Despite the growth in crude steel production, India's ferrous scrap imports edged down by over 20% y-o-y in FY'25 due to higher uptake of domestic scrap and partial replacement of scrap by domestic ore-based metallics such as DRI due to cost considerations and easier availability.

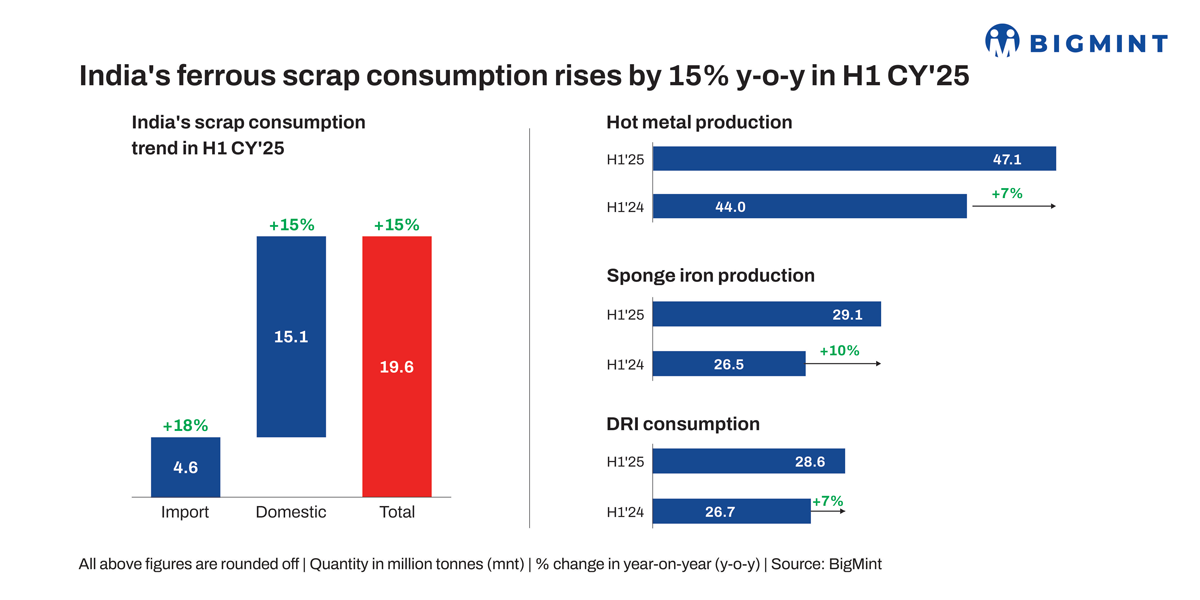

India's sponge iron output grew 10% y-o-y in H1CY'25, reaching 29.05 mnt compared with 26.5 mnt in H1CY'24. The increase reflects a steady rise in secondary steelmaking activity. Consumption rose by 7% y-o-y to 28.57 mnt in H1CY'25.

Scrap consumption and share of imports

India's ferrous scrap consumption increased by 15% y-o-y to 19.64 mnt in H1CY'25, up from 17.04 mnt in the same period last year. Imports jumped 18% to 4.58 mnt, while domestic consumption grew 15% to 15.08 mnt.

Data show that domestic ferrous scrap generation rose by 7% y-o-y in the last fiscal to over 32 mnt compared with 30 mnt in FY'24. Boosting scrap generation through upgradation of domestic recycling infrastructure and bolstering end-of-life scrap processing are key pillars of government policy.

However, the gap between demand and generation of scrap is still quite wide, which will reinforce India's dependency on imports going forward.

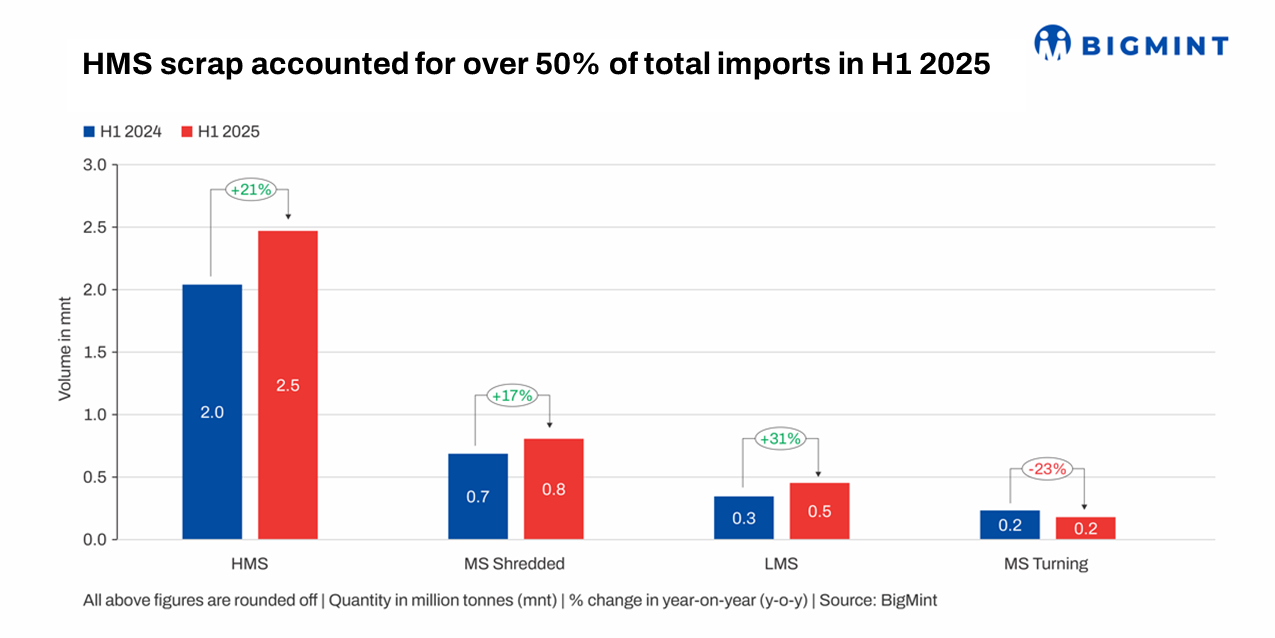

Grade-wise imports

HMS imports surged 21% to 2.47 mnt, while mild steel shredded scrap intake increased 17% to 807,045 t. LMS posted the sharpest gain of 31%, reaching 453,899 t. MS Turning scrap imports declined 23% to 180,720 t, reflecting weaker preference for the grade.

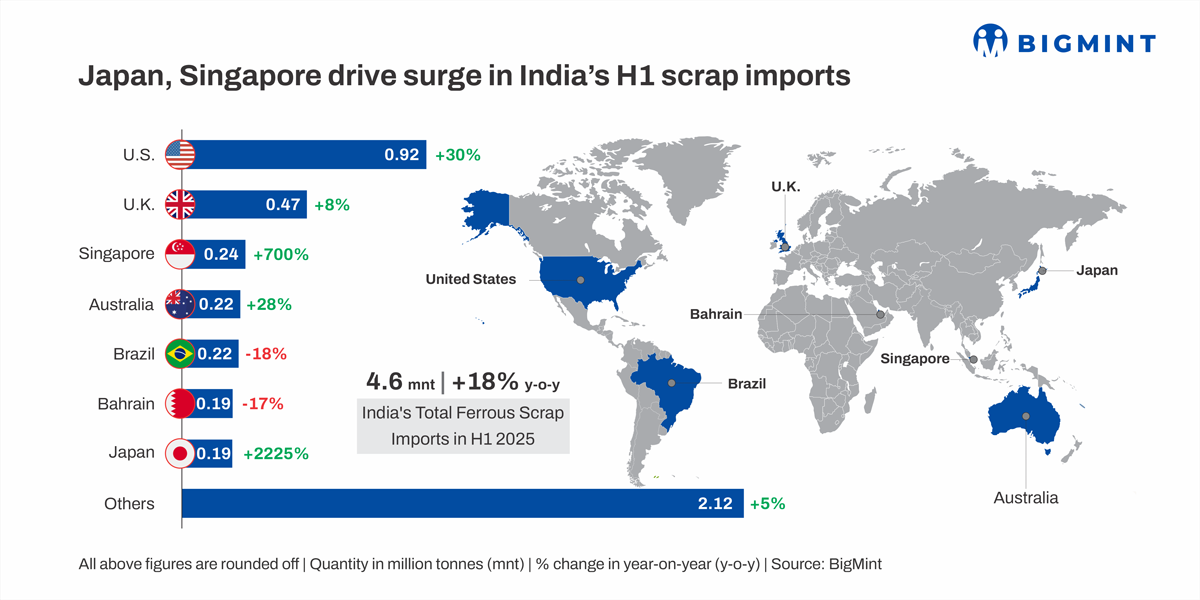

Country-wise imports

The US remained a major source, with shipments to India climbing 30% y-o-y to 922,799 t. UK supplies rose 8% to 473,404 t.

Japan expanded its presence with a more than 20-fold jump in shipments, while Singapore recorded a nearly six-fold increase. Australia's exports to India also increased 28% to 221,761 t. Meanwhile, Brazil and Bahrain saw declines of 18% and 17%, respectively.

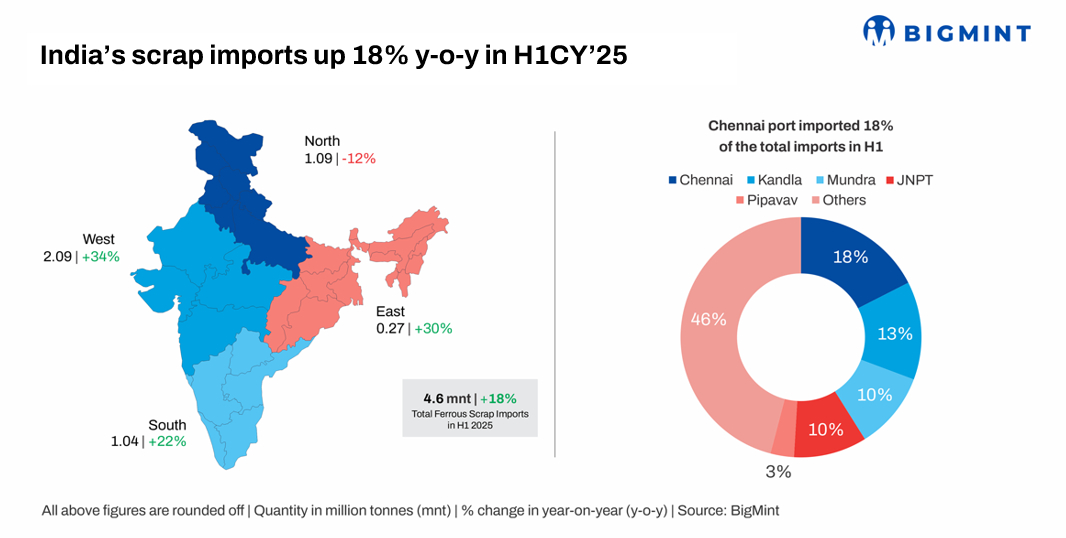

Regional distribution of imports

Imports increased in most regions of the country, with western India leading at 2.09 mnt, up 34% y-o-y. South India received 1.04 mnt, up 22% compared with H1CY'24, while the eastern region recorded a 30% increase in imports at 0.27 mnt. North India was the only region to register a decline of 12% to 1.09 mnt.

Factors boosting imports

- Steel production growth: India's crude steel output edged up by 8% y-o-y to 80.08 mnt in H1CY'25, while hot metal production increased 7% to 47.13 mnt. Increased steel production from the oxygen and electric routes of steelmaking boosted scrap demand and imports.

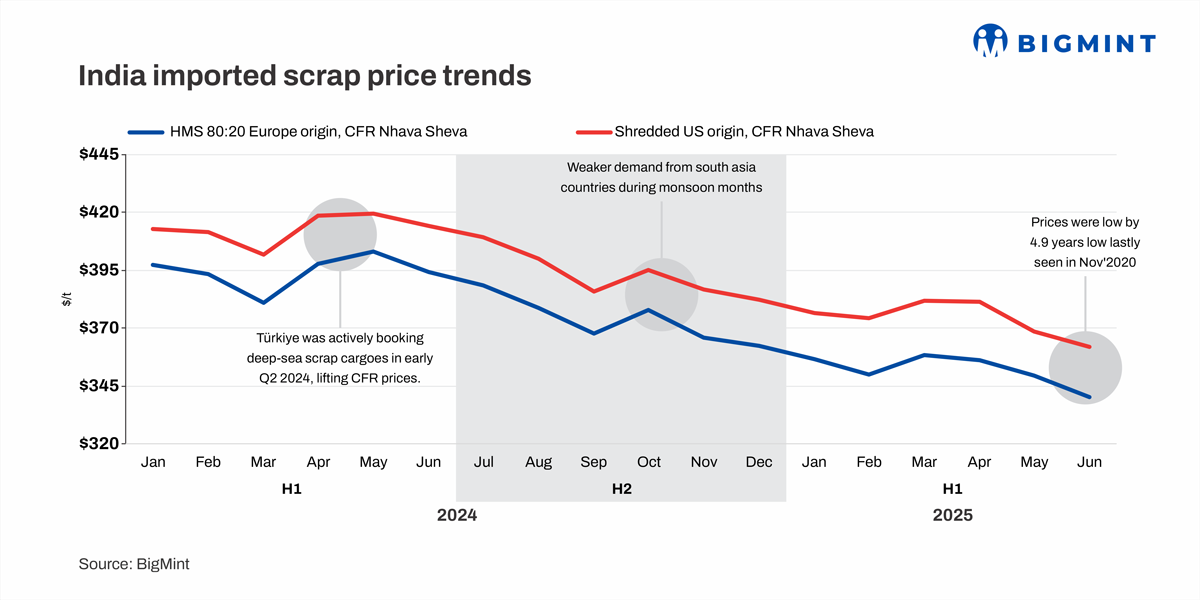

- Competitive import prices: US-origin shredded scrap prices averaged $374/t in H1CY'25, down 9% from $413/t in H1CY'24. European HMS (80:20) prices averaged $352/t, down 11% from $395/t. With prices edging lower, imports turned out to be cost-effective for domestic buyers.

Outlook

Scrap imports are expected to remain strong in H2CY'25 on crude steel production growth and expanding steelmaking capacity. Domestic scrap generation is set to climb to approximately 47 mnt by FY30, as per BigMint projection, but demand will outpace supply, rising to 54 mnt, leaving a widening deficit that will create demand for imports.

With global decarbonisation tightening scrap availability, India may face challenges in sourcing competitively and at scale going forward. That is the most critical challenge that confronts the domestic steel industry.