15-August-2025

- Govt sets CO2 reduction targets for 253 steelmaking facilities

- Green public procurement key driver of low-CO2 steel in near term

- CBAM threatens to erode steel industry's global competitiveness

Morning Brief:With the rapid expansion in BF-BOF steelmaking capacity in India, the adoption of energy efficient technologies in primary steel production will gather momentum in the coming years.

Technologies such as utilisation of waste heat, efficient recycling of steel mill gases, increased use of pellets and prepared burden, the use of biochar and COG in the blast furnace and a higher share of scrap in the BOF are some of the best available technologies (BATs) essential for incremental decarbonisation in the short term.

Step-by-step reductions in GHG emissions are necessary in order to comply with targets being set by the government. The Bureau of Energy Efficiency (BEE) under the Ministry of Power, the agency entrusted with MRV (monitoring, reporting, verifying emissions from industrial sources) functions, green steel certification and maintenance of carbon registries under the evolving Indian Carbon Market (ICM).

Carbon market & green procurement

The BEE has set GHG emissions reduction targets for as many as 253 obligated entities in the iron and steel sector spanning both the primary and secondary sectors. Near-term CO2 reductions are set as targets for FY26 and FY27 against the baseline GHG emissions for FY24.

Notably, as many as 32 steel units in the country, with cumulative production of over 5.6 mnt in FY25 already comply with the government's star-rated classification system, with emissions between 1.6 tCO2/tfs (tonne of finished steel) and 2.2 tCO2/tfs). Only a few mills are below 1.6 tCO2/tfs. However, none of the primary steel producers have emissions below 2.2 tCO2/tfs.

This means that the primary steel producers will not be eligible to supply green steel for public infrastructure projects in the near term. The government will soon launch a GPP (green public procurement) programme which is most likely to formulate a quota-based system for purchases of low-emission steel for infra projects.

Steel constitutes 18-21% of the total expense in infrastructure projects. Steel Ministry projections show that if it is assumed that the share of green steel is 5% for FY27 and FY28, increasing to 10% for FY29 and FY30, and reaching 15% for FY31, the total GPP of steel from FY27 to FY31 could be 27.2 million tonnes (mnt) for infrastructure.

This is an assumed scenario and we don't know what the exact quantum of GPP will be in FY31. But GPP is the main driver of low-emissions steel production in India today and the roll out of the ICM and green steel classification system was a precursor to the eventual implementation of GPP.

Only one integrated producer has been given the target of lowering emissions below 2.2 tCO2/tfs till FY27. Till FY30 it is expected that at least two others will be able to reach a level below 2.2 tCO2/tfs. India's target is to reduce the average steel industry intensity to 2.2 tCO2/tcs (tonne of crude steel) by 2030. But the primary producers risk missing the GPP bus if incremental reduction strategies are not implemented at the earliest.

Maintaining global competitiveness

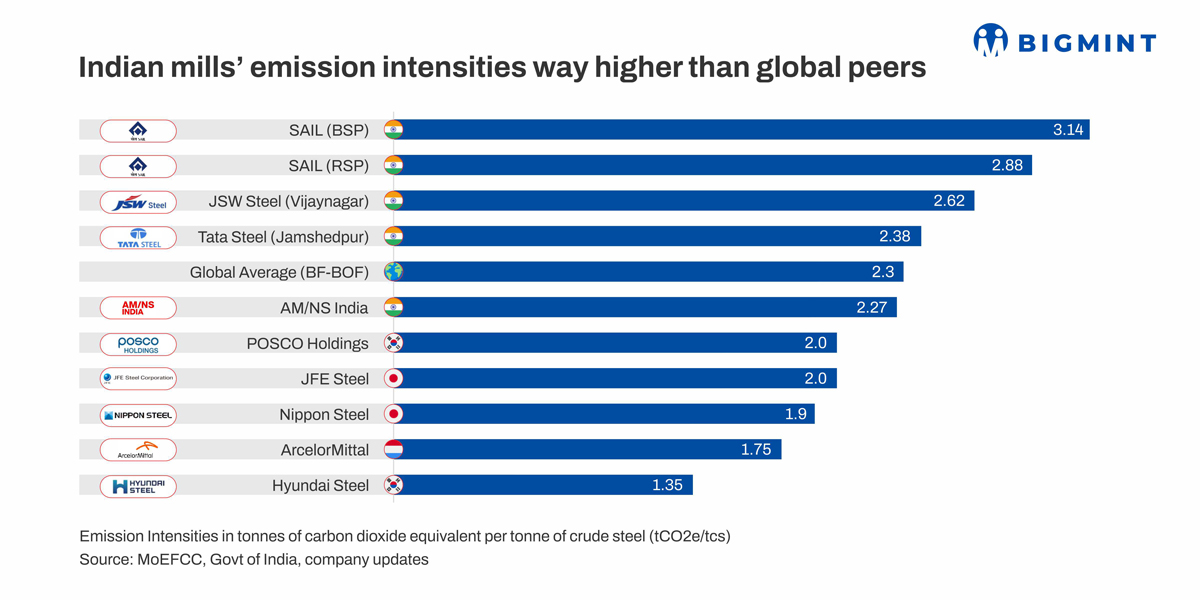

One other factor that is of considerable significance is the impending full implementation of the EU's CBAM in January CY26. As the graph on top shows, Indian mills have an inherent disadvantage in terms of emissions from production compared with their global peers due mainly to raw material quality issues, but also due to insufficient access to clean energy, domestic scarcity of low-carbon fuels and scrap and meagre R&D expenditure in the steel industry.

However, carbon border mechanisms like the CBAM do not account for the historical inequalities in economic development and discrepancies in raw material endowments or availability. Therefore, to maintain global competitiveness and as one of the major exporters of finished steel to the EU, Indian primary steel producers have to implement short-term interim strategies such as increasing scrap-based EAF production and natural gas-based DRI with incremental intake of hydrogen, etc. to lower their overall emissions profile.

For CBAM product embodied emissions will be calculated and so energy efficient blast furnaces with state-of-the-art injection systems and provisions for retrofits will be increasingly preferred. Implementation of BATs will be prioritised and material efficiency measures will be undertaken at a large scale.

Both global and domestic pressures, therefore, are expected to drive the primary producers of steel to adopt low-carbon technologies and target gradual, incremental decarbonisation.

BIFW

Learn more about how government policies in the EU, US, and Asia are driving demand for low-CO2 steel and the economics of green steel in India from experts joining the session 'Green Steel Economics: Who Will Pay the Premium?' at the BigMint India Ferrous Week (BIFW) to be held between 19 and 21 Aug'25 at Kolkata, India