25-June-2025

- Australian exports drop 7% y-o-y in 5MCY'25

- India's imports of Russian coal up 70% y-o-y

- Indian mills optimising coal blends, diversifying import sources

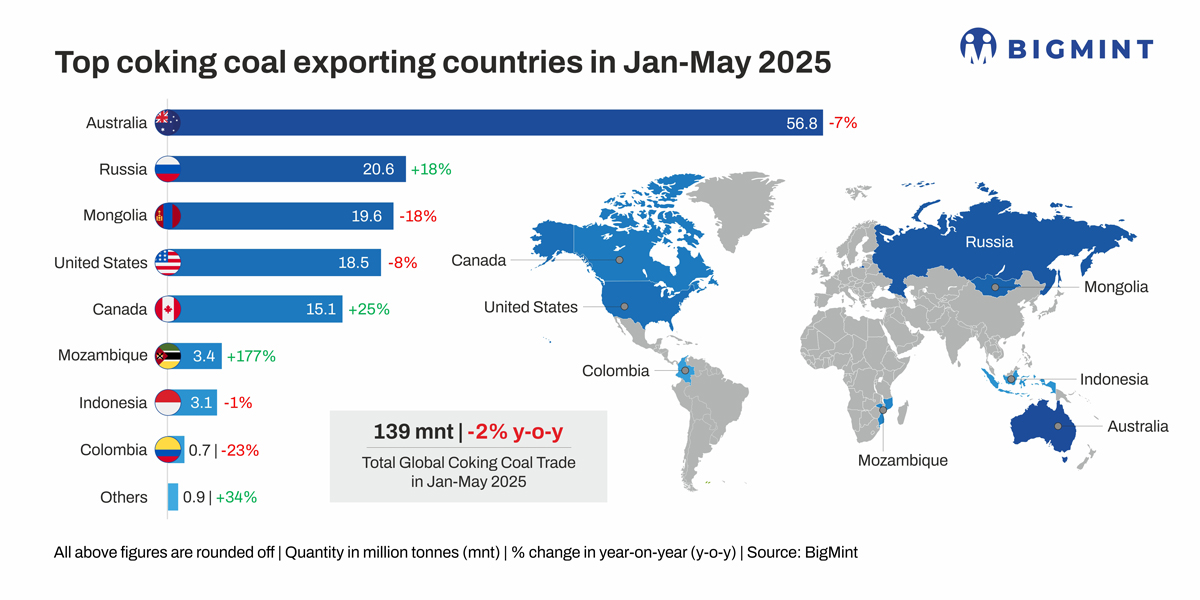

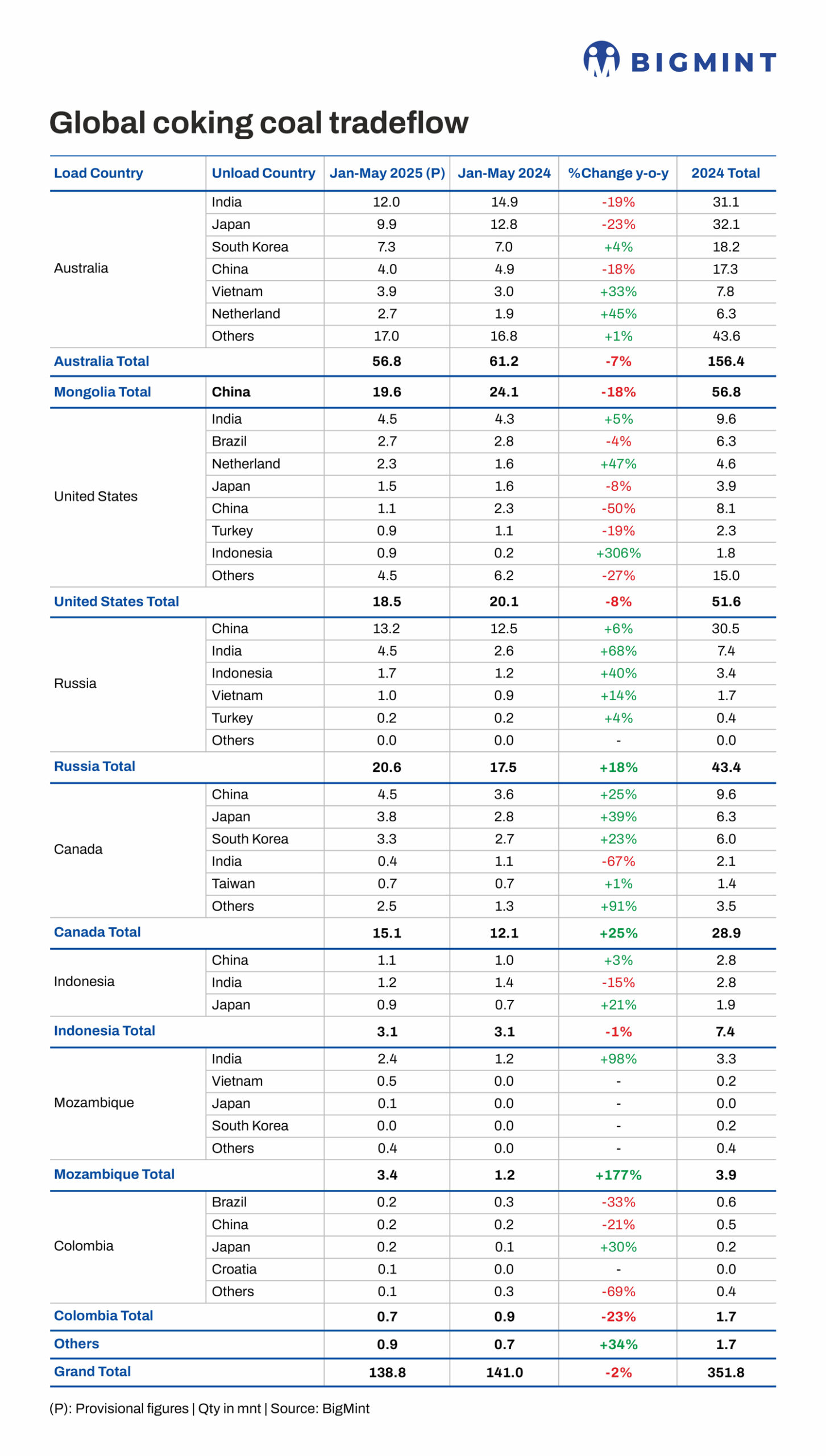

Morning Brief: Global metallurgical coal exports declined marginally by 1.5% y-o-y in January-May 2025 (5MCY'25) to around 139 million tonnes (mnt) compared with 141 mnt in the corresponding period of CY'24, as per provisional data available with BigMint.

Almost all the key exporting countries, with the notable exception of Russia and Canada, witnessed a decline in shipments in 5MCY'25.

Global crude steel production in 5MCY'25 decreased by 1.3% y-o-y to 784 mnt, as per WSA data. Weakness in steel production and prices globally owing to economic and trade uncertainties, tariffs, slowdown in Chinese steel demand amid the real estate debt crisis, economic contraction in the advanced Asian economies and high inflation and energy prices in the EU, weighed on metallurgical coal demand.

Global met coal market dynamics

Australian exports drop 7% y-o-y: Australia, the top global exporter of coking coal (both prime low-volatile and semi-hard, semi-soft grades), saw exports declining to around 57 mnt in 5MCY'25. Australian exports were assessed at over 156 mnt in CY'24. While exports to India fell by 20% y-o-y to 12 mnt, shipments to Japan declined by 22% y-o-y.

Except decreased demand from the major buyers, as well as China, Australian shipments also dropped partly due to the key Queensland coal ports experiencing a 35% y-o-y decline in exports in February, coinciding with heavy rainfall in North Queensland.

Indian mills diversifying sources, blends: For Indian mills, especially after the sharp spike in prices in 2021 and 2022, coking coal remains a highly volatile commodity. Indian BF-based steel producers are diversifying sources of imports, especially with Russia offering extremely competitive prices due to sanctions, and reducing reliance on Australian PHCC. Some mills are also investing in overseas coking coal mines to secure supplies of this critical resource.

Market sources indicate that sourcing different grades and experimenting with newer coal blends for blast furnace iron production are essential to reduce dependency on PHCC. Mills are experimenting with semi-hard, mid-to low-volatile coking coal in different blends to determine their impact on hot metal quality and composition, as well as the operating parameters of the blast furnace. In fact, sourcing from different countries and sources amid market volatility have made it imperative for the domestic mills to try out new blends and grades.

This trend may really have accelerated, which could be a firm reason for imports of coking coal from Australia falling sharply in 5MCY'25, although total imports by India remained stable y-o-y during the review period at over 24 mnt.

Japanese steel production declines: As per Japan's Ministry of Economy, Trade and Industry's (METI) production plan for the April-June period, crude steel production will decline by 4.3% y-o-y. Amid sluggish growth in demand for steel products both in Japan and overseas, there are concerns about the impact of US tariff policy on the export-dependent Japanese economy.

Sales for automobiles have been sluggish despite the recovery in production by automakers. In particular, exports are sluggish. The construction industry is facing the brunt of acute labour shortage. Steel production in Japan fell by 3.4% y-o-y in CY'24. This trend is continuing in CY'25, thereby impacting coal demand.

Chinese coking coal demand largely stable: Imports by China dropped in 5MCY'25 but only marginally. Higher domestic production in China was the reason. According to the National Bureau of Statistics, China's total coke output in Jan-May reached 207.23 mnt, up 3.3% y-o-y. Raw coal production rose by 4.2% y-o-y in May to 400 mnt.

In 5MCY'25, raw coal output grew 6% to 1.99 bnt. In CY'24, an increase in safety-related monitoring had an adverse impact on metallurgical coal production in China. Increased imports of over 122 mnt coincided with historically high Chinese stockpiles.

Therefore, dependency on imports has decreased in CY'25. Also, higher purchases from Russia and Mongolia have offset Australian volumes. Mongolia has high quality coal with low transport costs and Russian coal sells at a discount due to sanctions. Close to half of Chinese imports were from Mongolia in 2024, as new rail infrastructure and a lack of alternative trading partners drove purchases.

However, higher domestic supplies in China and unwillingness of Chinese buyers to follow Mongolian coal e-auction prices on the countrys stock exchange impacted Mongolian exports in 5MCY'25.

Russia ramps up exports: Russia increased met coal exports in 5MCY'25 by 18% mainly due to higher shipments to India and China at competitive prices. Russian exports increased by 16% in CY'24 as trade sanctions continued to have a limited effect on trade volumes. Russian exports remained reliant on China and India during CY'24, with a 92% market share between them.

Completion of new transport infrastructure in eastern Russia is expected to offset the impact of mine closures and declining profits of Russian miners, as well as high rail freights.

US exports dip: Exports of met coal by the US dropped 8% y-o-y during the review period because of the plunge in exports to China following announcement of tariffs. The US is seeking to channel higher exports into the developing Asian market at a time of declining demand in the EU. But high costs of production, surge in freights, etc. are hurdles.

Canada, however, saw exports increasing significantly in 5MCY'25. Glencore's acquisition of Elk Valley Resources is expected to boost met coal shipments from Canada going forward.

Outlook

If crude steel production cuts in China actually materialize towards the end of the year, the pressure on global met coal trade is likely to intensify. This is because surging Indian and Southeast Asian demand is unlikely to offset the decline in Chinese met coal demand.

Supplies, on the other hand, are expected to rise from Australia, with major mines likely to approach full production capacity. Mining major BHP, with a share of around 23% of Australian met coal exports in CY'24, is likely to reach the upper end of its guidance of 33-38 mnt for 2024-2025. If Chinese demand wanes, Australian coal prices are expected to come under pressure amid increasing supplies.

Indian mills, on their part, are likely to prioritise competitive prices going forward, with the experiment with different sources and blends, as well as newer coke-making technologies for increasing domestic coal use, likely to affect imports. However, dependency on prime coking coal from Australia is likely to remain in the foreseeable future.

As Indias steel industry accelerates its transition, coking coal demand patterns are shifting. From diversifying import sources to increasing PCI usage in blast furnaces, Indian steelmakers are reworking their raw material strategies. What does this mean for future coking coal requirements? Know more at BigMint India Ferrous Week2025, August 1921 at JW Marriott, Kolkata and stay ahead of the curve.