04-July-2025

- Global crude steel production down 2% in Q1CY'25

- Turkiye sees 12% y-o-y drop in imports in Jan-Mar'25

- Trade flow affected by protectionist policies, volatile steel market

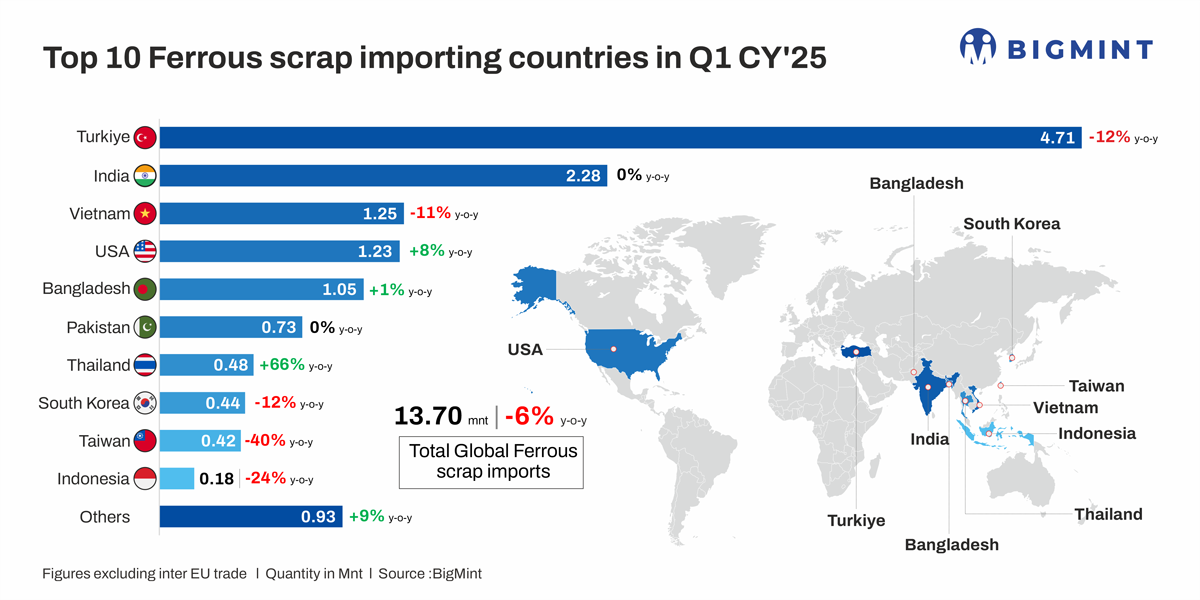

Morning Brief: Global seaborne ferrous scrap trade volumes, excluding intra-European trade, dropped around 6% y-o-y in January-March 2025 (Q1CY'25). Total imports in Q1 declined to around 13.7 million tonnes (mnt) compared to almost 14.5 mnt in Q1CY'24, as per latest data available with BigMint.

Major importing countries in Q1CY'25

Turkiye remained the global leader in ferrous scrap imports; however, volumes dropped by 12% y-o-y. India remained the second-largest importer with 2.3 mnt in Q1, a marginal decrease y-o-y.

Other key importers in East Asia, like Taiwan, Vietnam and South Korea, also witnessed declines in scrap imports ranging from 11% to 40% y-o-y. On the other hand, higher imports by the US and Thailand balanced the sharp fall in seaborne trade.

Why did global scrap trade shrink in Q1CY'25?

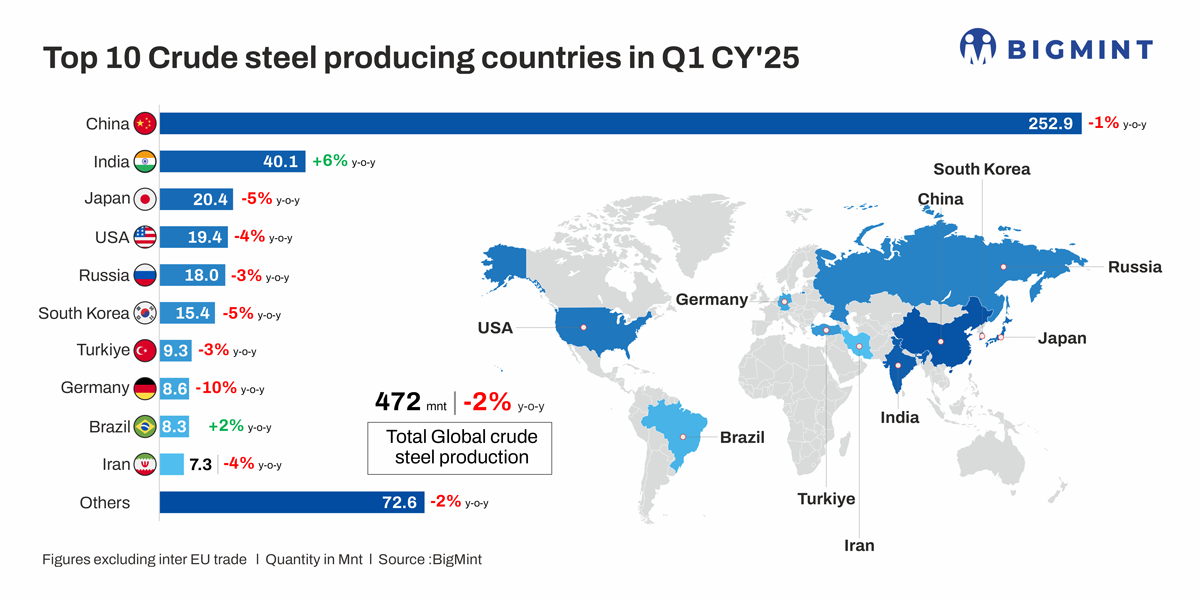

Decline in crude steel production: Global crude steel production fell by 2% to around 472 mnt in Q1CY'25 as compared to 480 mnt in the year-ago period, as per WSA data. This accounts for the slight decline in seaborne ferrous scrap trade during the period.

Notably, crude steel production declined in all the major scrap consuming countries such as Turkiye, the US, South Korea, Vietnam and Taiwan. China, Bangladesh, and Turkiye, witnessed muted demand due to prolonged construction slowdowns and limited infrastructure spending.

Currency depreciation, shrinking foreign exchange reserves, and inflation impacted steel demand which weighed on steel production in Pakistan and Bangladesh. Higher consumption despite lower imports, such as by Turkiye, explains the reliance on domestic sourcing.

Top importing nations see drop in shipments: Turkish imported scrap prices surged in the March quarter compared with Q3 and Q4 of CY'24 which kept mills wary. Despite firm scrap prices q-o-q, quarterly average rebar prices fell and the rebar-to-scrap spread narrowed by around $17/t to $207/t in Q1CY'25 compared to $234/t in Q4CY'24. Furthermore, a depreciating currency and higher domestic generation led to a 12% y-o-y drop in imports in Q1CY'25.

Vietnam's ferrous scrap imports fell by over 11% y-o-y to 1.25 mnt, down from 1.4 mnt recorded in Q1CY'24. Scrap imports stayed low due to Tet holiday slowdowns, rainfall affecting construction activities in northern Vietnam, and cautious restocking despite marginal growth in crude steel production during the period. As Japanese H2 scrap offers edged up, buyers preferred domestic scrap amid bid-offer gaps and high import costs.

India's scrap imports edged down marginally despite a 6% y-o-y growth in crude steel production due to better domestic generation and trade. European shredded scrap prices fell by $35/t in the March quarter as compared to Q1CY'24; the Indian steel market witnessed a sluggish quarter which pushed buyers into need-based purchases and a drop in bulk import volumes.

Chinas billet export surge in Q1 CY25: Chinas billet exports soared by 381% y-o-y in Q1 CY'25, reaching 2.54 mnt up from just 0.53 mnt in Q1 CY'24. This sharp rise was fueled by aggressive shipments to key destinations including Indonesia (0.64 mnt, +5,123%), the Philippines (0.36 mnt, +652%), and Saudi Arabia (0.35 mnt, +34,653%).

Turkiye, a major scrap-consuming nation, also emerged as a growing buyer, importing 0.09 mnt from China in Q1 CY'25 compared to nil volumes in the same period last year, reflecting China's growing price competitiveness across global markets. Italy was the only major destination to witness a y-o-y decline (-15%).

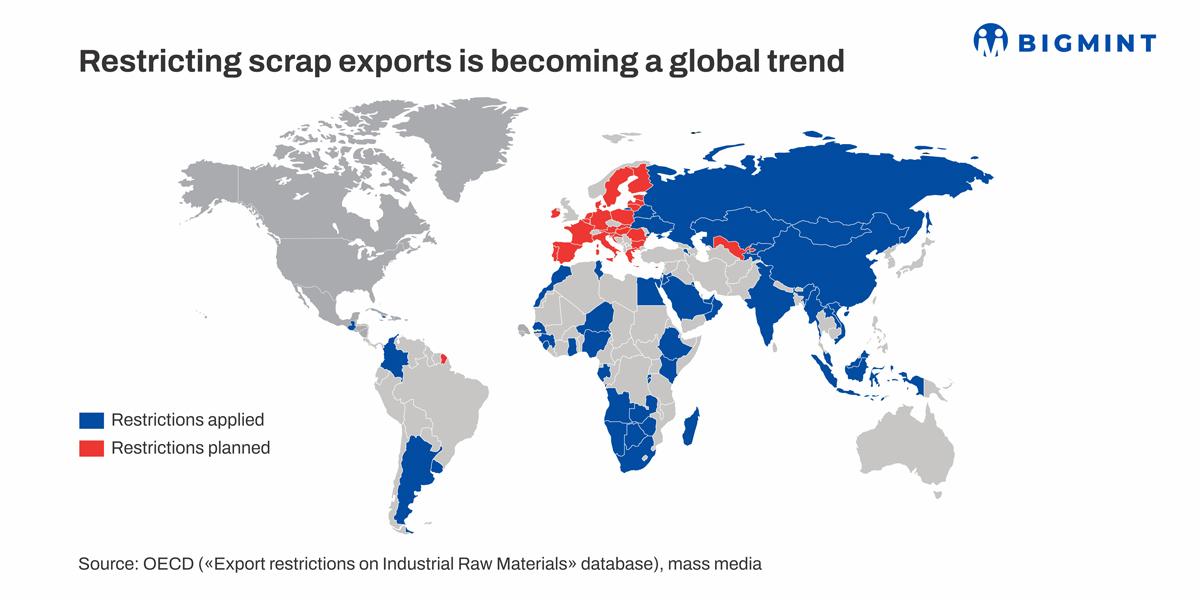

Growing scrap export restrictions: Ferrous scrap export restrictions are becoming more widespread globally. As of March 2025, around 48 countries have imposed 75 different restrictions on scrap exports, with 38% of these measures involving partial or complete export bans.

Countries have adopted a range of measures to regulate ferrous scrap exports, including export tariffs (27%), export licenses (27%), and export bans (25%). Tariffs are often applied with flexibility, but a growing number of nations are opting for stricter export bans.

The European Union is also revised its waste transport regulations in 2024 to limit ferrous scrap exports to non-OECD countries and is considering further measures by Q3CY'25. The United Arab Emirates has lifted its export ban but continues to regulate exports through the introduction of tariffs starting in CY'24.

Outlook

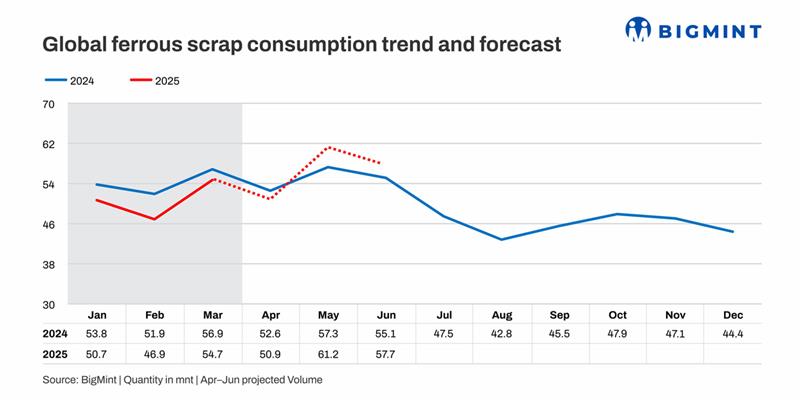

In Q2CY'25, global ferrous scrap imports are expected to remain subdued amid weak steel demand and cautious buying. South Asian buyers, especially in Bangladesh and Pakistan, are likely to continue facing dollar crunch restricting bulk purchases.

Indian importers may remain active but opportunistic, stepping in only during price dips due to heightened sensitivity to finished steel margins and rising safeguards on cheaper steel imports.

Turkish mills are expected to maintain moderate import volumes, relying more on semis to manage input costs as scrap prices remain firm. In Southeast Asia, rising billet imports from China to Vietnam and Thailand might cap the rise in scrap imports.

Overall, in Q2 imports are likely to show a marginal recovery compared to Q1 but will remain well below historical averages, with trade flows increasingly pushed by protectionist policies and volatile regional steel market conditions.

Scrap consumption is expected to continue its downtrend in the first half of CY'25, with BigMint forecasting 322 mnt of usage in H1CY'5, a slight 2% drop from 328 mnt in H1CY'24. However, H1CY'25 is expected to see a strong 17% recovery from the 275 mnt in H2CY'24.