28-August-2025

- India remains top exporter of ferro and silico manganese

- Decline in global crude steel output, geopolitical crisis affect trade

- Growing protectionism, especially in EU, to impact Indian exporters

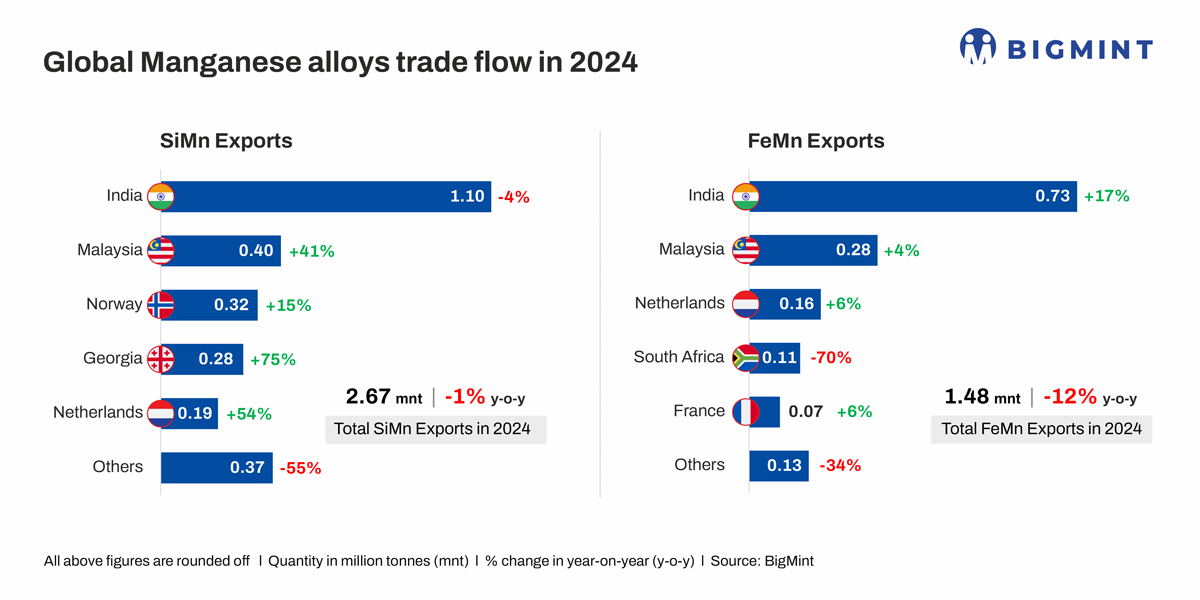

Morning Brief: Global manganese alloys exports dropped by 5.5% y-o-y in CY'24, according to latest data available with BigMint. Total trade in manganese alloys dropped to 4.15 million tonnes (mnt) in CY'24 from 4.39 mnt in the year prior.

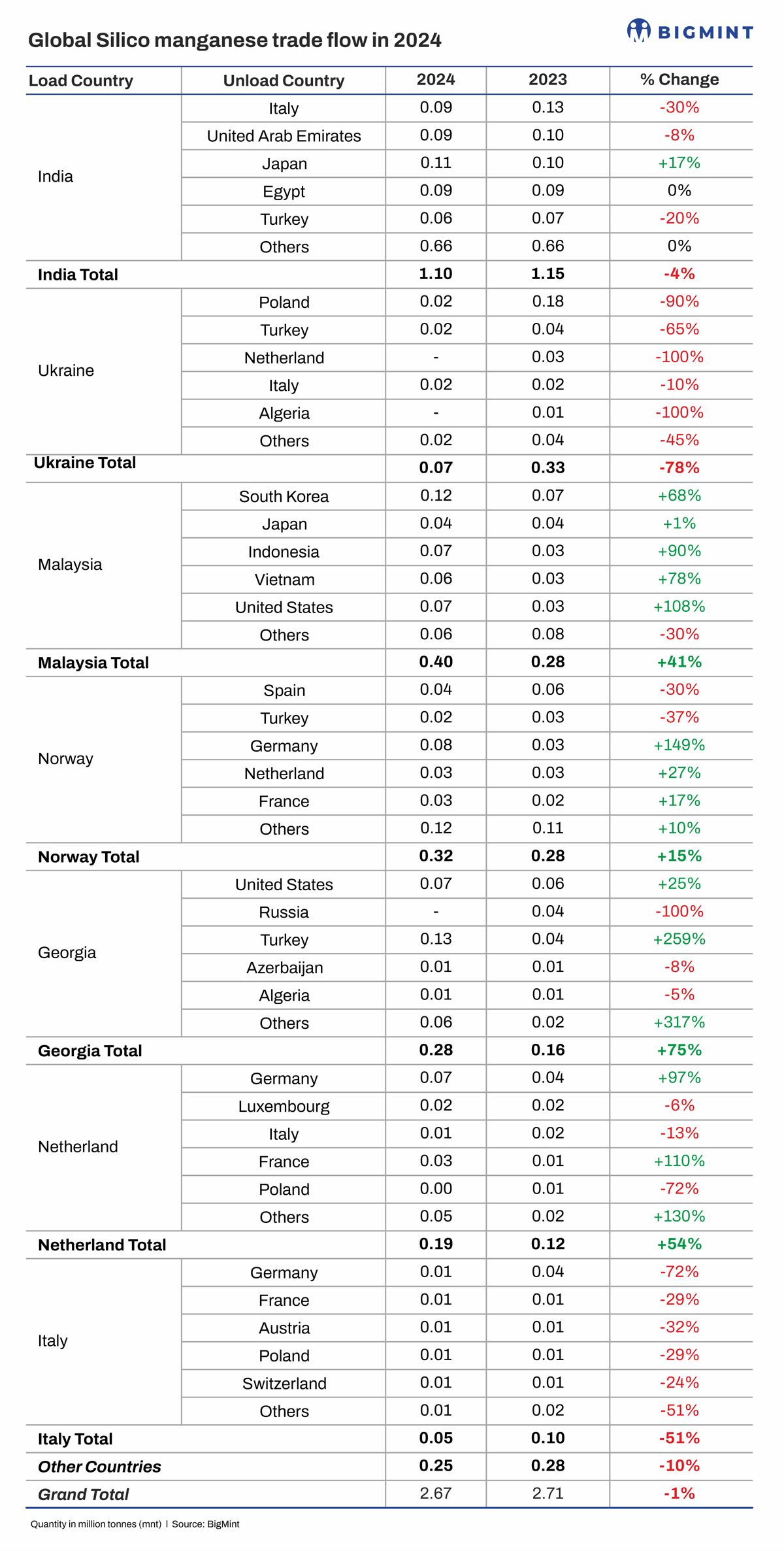

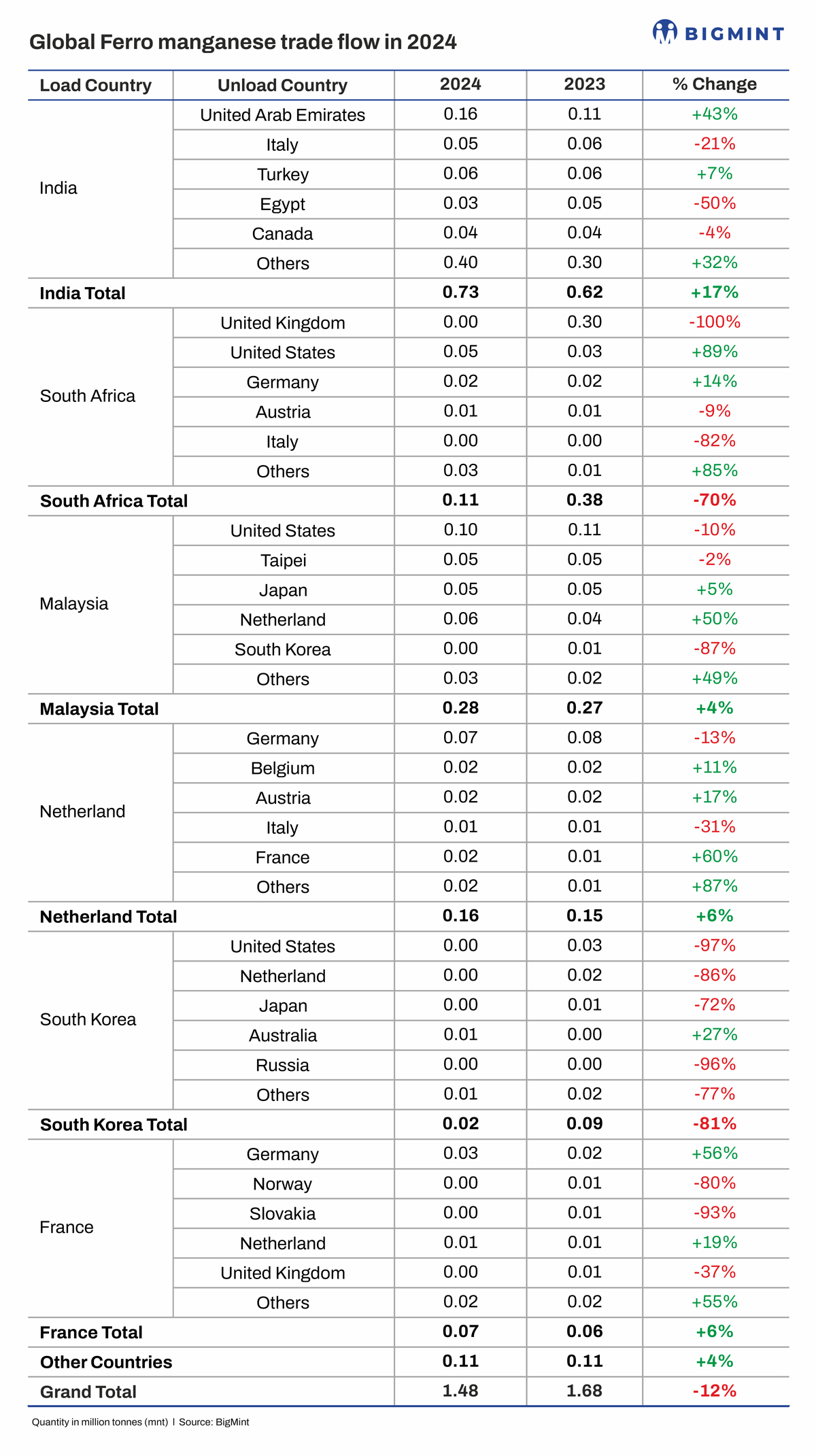

While silico manganese exports fell from 2.71 mnt in CY'23 to 2.67 mnt in CY'24, ferro manganese trade shrunk to 1.48 mnt from 1.68 mnt in CY'23.

Notably, India remained the top exporter globally of both silico and ferro manganese. India's exports of silico manganese declined marginally in CY'24 to 1.1 mnt. Ferro manganese exports, however, witnessed an uptick, reaching 0.73 mnt in CY'24.

Among the other major suppliers, Malaysia saw higher exports on increased production and capacity expansion, while South African exports of ferro manganese declined y-o-y. Ukraine saw a sharp drop in export shipments due to the ongoing war and logistical disruptions.

Factors affecting manganese alloys trade in CY'24

Factors affecting manganese alloys trade in CY'24Drop in global crude steel production:In CY24, world crude steel output fell by 0.9% y-o-y to 1,882.6 mnt, as per World Steel Association data. Output declined in China by 1.7% y-o-y, or a little over 17 mnt y-o-y. Crude steel production in the EU, Japan and South Korea dropped significantly. The decline in steel production had a direct impact on manganese alloys demand.

Sluggish steel demand:Manganese alloys are mainly used in steelmaking. Slowdown in steel demand globally due to weaker construction, infrastructure, and automotive sector sentiments amid high inflation, geopolitical tensions, and steel overcapacity in some regions directly impacted the demand for ferro alloys.

Geopolitical crisis, surging logistics & freight costs:Geopolitical conflicts such as the Russia-Ukraine, economic uncertainty and trade disruptions such as the Red Sea crisis affected key shipping routes and triggered container shortages, increased costs and delayed shipments. This reduced the flow of commodities exports and affected trade flows.

Indias growing demand may limit exports: Indias manganese alloys production grew 15% y-o-y to 5.18 mnt in FY'25. Ferro and silico manganese output climbed by around 50% over FY'21-FY'25 to reach 2.31 mnt and 2.88 mnt, respectively.

With Indias crude steel output consistently rising y-o-y (it increased by around 9 mnt y-o-y in CY24) the consumption of manganese alloys will certainly increase. Indias economic growth and major infrastructure projects will fuel steel demand, with crude steel output projected at 210-220 mnt by FY'30, driving strong ferro alloys consumption.

BigMint projects exports to remain at a level of 2-2.5 mnt, while domestic consumption may increase to 4-5 mnt.

Malaysian smelters post record production growth:Malaysiaraised its production and exports of manganese alloys significantly in CY'24. The South Asian country increased its exports of silico manganese by over 40% y-o-y.

Major producer OM Holdings reported higher revenue of $654.3 million in FY'24, driven by higher volumes of alloys traded. With an average 15 out of 16 furnaces in operation last year, the company achieved record production levels, surpassing 500,000 t of alloys (ferro silicon and silico manganese) in both output and sales.

Outlook

Global trade in manganese alloys is expected to shrink further in CY25 as protective trade measures and mounting tariff walls impact the free flow of commodities across borders. The export market for India is expected to remain firm but the EUs safeguards, if imposed, could pose a hurdle to Indias ambitions, given that the region is a key importer. If curbs are placed, exporters are likely to explore new markets and diversify from traditional destinations.

There is a general feeling that China and India are responsible for triggering oversupply in the global market and trade protective measures are being increasingly adopted.

On the other hand, global crude steel production, as per WSA, dropped 1.9% y-o-y in January-July this year, with the worlds top ferro alloys consumer China witnessing a drop of over 3% y-o-y in crude steel production till July this year. This will obviously impact the demand for ferro alloys used in steelmaking.

Listen to industry experts and gain insights on "Balancing Manganese Alloys - Demand vs Resources" at the 5th International Ferro Alloys Conference 2025 - Navigating Trade Uncertainties: Sustainable Growth in Ferro Alloys, to be held over 2-4 September at JW Marriott, New Delhi.